Post from 2016

It is now 2 weeks, since the old 500 and 1000 rupee notes in India have lost their value and the new 500 and 2000 rupee notes have been introduced. Only yesterday I returned to Delhi from my ten-day Malaysia trip and I had hoped a little, that during this time the money situation in India would calm down and I could easily withdraw new money at the ATM and exchange my old notes.

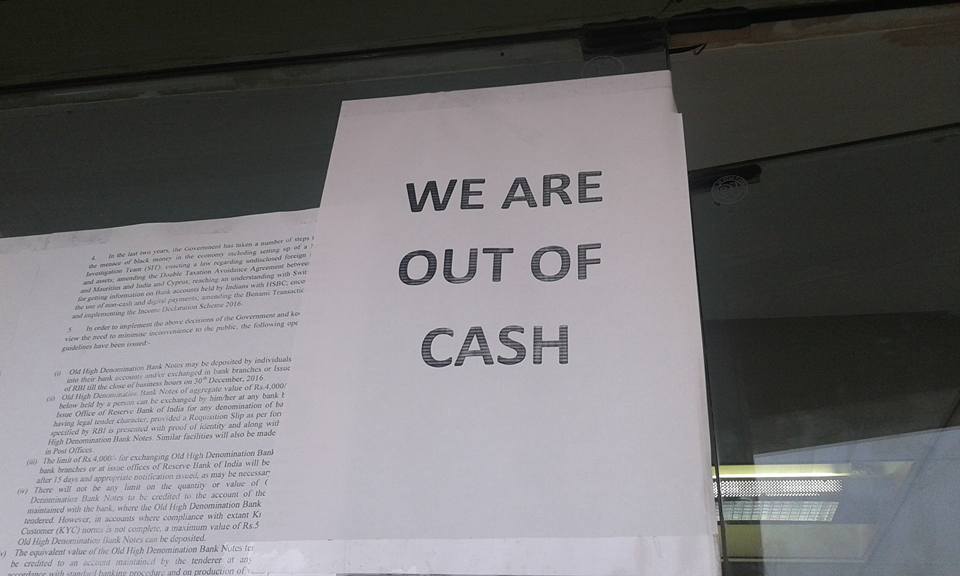

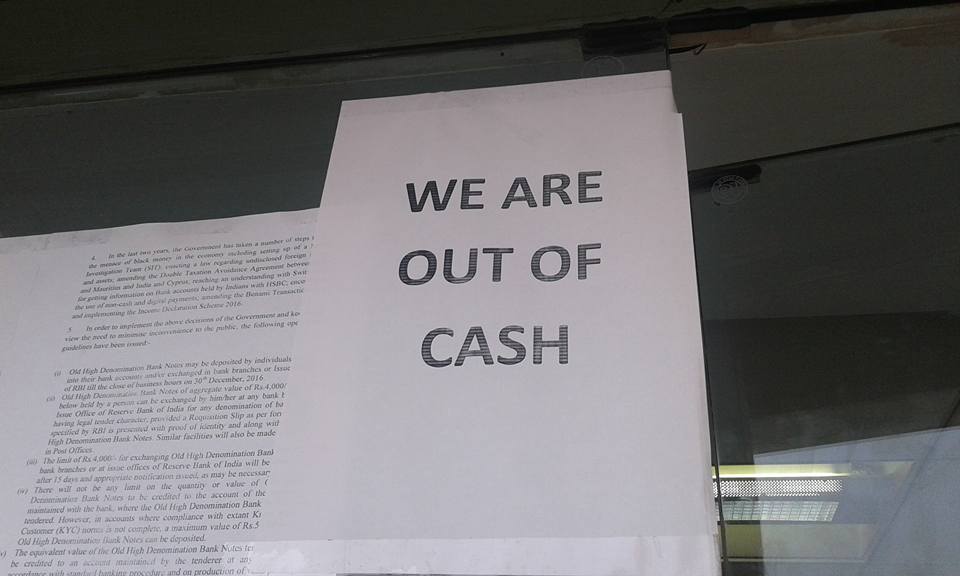

But that was not the case: long queues in front of all Atms, banks and post offices. This state will last at least for a few more weeks.

With 1.2 million Indians and a lot of new banknotes being introduced and old banknotes that needed to be withdrawn from circulation, it takes a while and is a huge logistical effort.

Only 2000 rupees are still allowed to be withdrawn per day per person (approx. 28 Euros) and even if you are lucky and the new 2000 rupee note comes out of the vending machine, it is difficult to make payments with it, because nobody has the necessary change available.

When I landed in Delhi late at night from my Malaysia trip, I cleared everything cashless with my credit card – going by metro, paying for my hotel room and my food. The next day, things were no different in Delhi. The queues in front of the banks formed long before the opening hours, I had no desire to stand in these lines and after all I belong to the few privileged with a credit card (25 million Indians own a credit card). For the other billion of Indians, things looked worse: although there are still 130 million so-called “mobile wallets”, which also allow cashless payments and 600 million debit cards, the rest of the Indian population has no cashless payment option. More than half of all Indians have no bank account and 300 million do not even have an ID do open one.

Farmers, street vendors and domestic workers earn their money in cash and then hoard it at home at some safe hiding places.

India is a “cash economy.” 90% of all payments have been made in cash so far. The transition from black to white money was often fluid – one back and forth, and besides that there is also the informal sector, to which the shoe cleaners, snack sellers and rickshaw drivers belong. This sector has come to a complete standstill in recent days.

Although I can survive well with my credit card in Delhi, it only works in large malls, hotels and restaurants that have a credit card reader. Unfortunately, I had to pass the fruit and vegetable vendors and street vendors and had to choose the more expensive option instead.

People complain that the measurement was done in the wedding season of all places and the farmers don’t have it easy either. Now they have to invest in the winter seed, but they only have limited money and had to borrow seeds expensively. After all, swift action has been taken here – you can now withdrawel 25,000 rs (350 €) a week.

But, of course, the devaluation of money has also hit the right people. Some politicians and Buisness people are now sitting on their worthless paper, and some of them have turned themselves in. Overall, the Indian support Modi in his plan and, despite the inconveniences, are firmly behind him and his decision.

But a lot of black money has been invested in land, buildings and jewelry before, or is in foreign bank accounts.

I myself am now back in Manali and here in the rural region the situation is much more relaxed.

Now a shift from the cash economy to the cashless economy in India is happening. At least some vegetable vendors and street vendors have already organized a credit card reader, even if that is more of an exception than the norm.

by now I have now also received my first new 2000 rupee note from the ATM!